Welcome to MacroFocus Portfolios

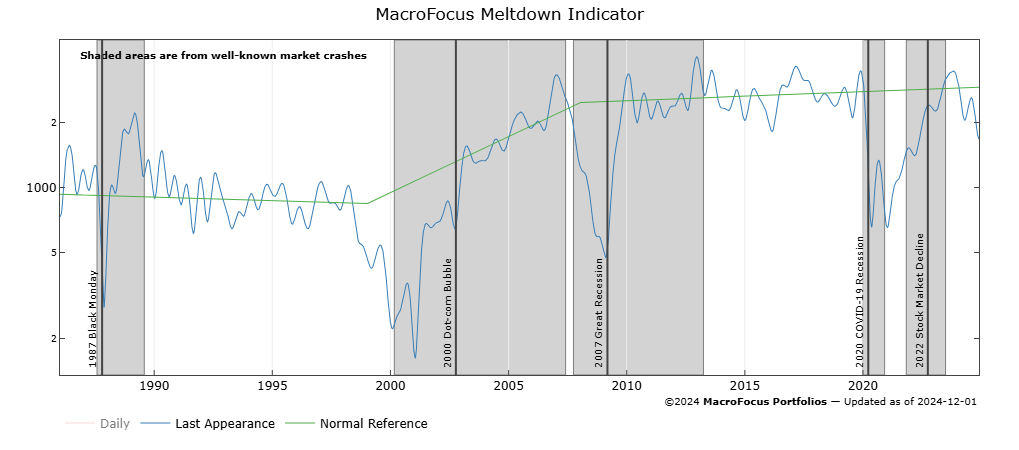

This website serves as my tool box for managing the portfolios of friends and family. Everything is free, and it only requires a social login via the button on the bottom right. Among the tools you will find here are:- Our MacroFocus Meltdown Indicator, developed in 2013 to avoid being in the equity markets as we were during the Great Recession.

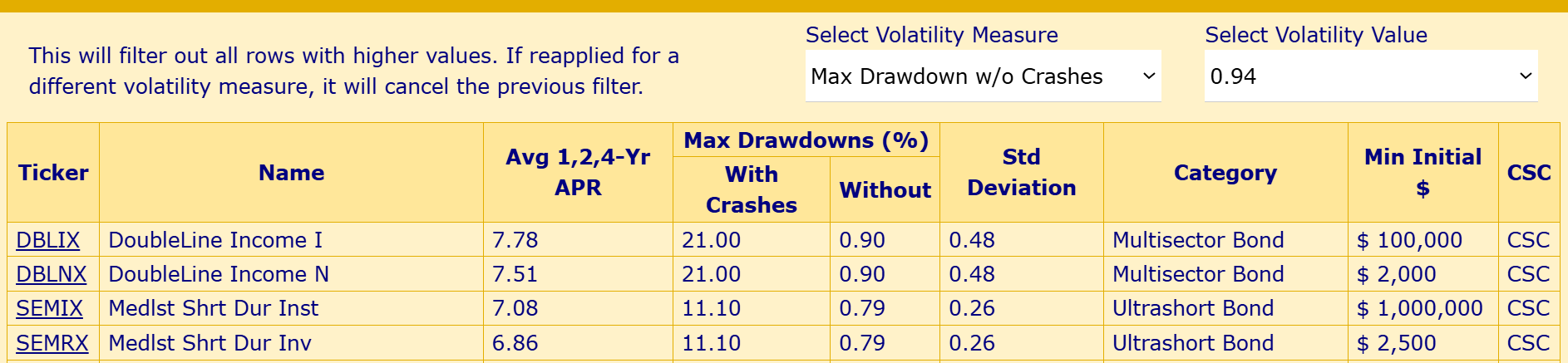

- Our Fund Table, ranked by average annualized return for 4, 2, and 1 years, spread over the complete spectrum of volatility as measured by maximum drawdown (with or without well known crashes), or simple standard deviation of returns, and they can be filtered by any of these measures. We prefer the

w/o Crashes

measure, as we intent do avoid crashes with our MacroFocus Meltdown Indicator.

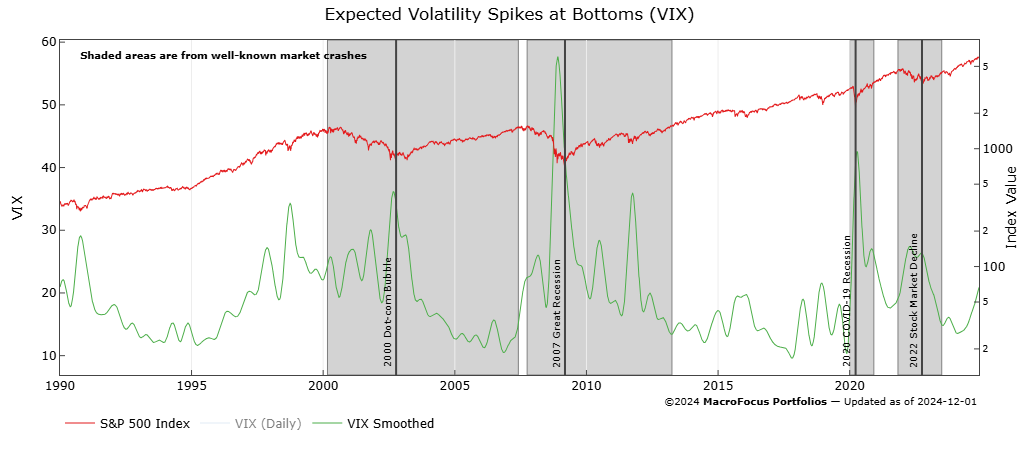

- Our Market Related Charts, which include the MacroFocus Meltdown Indicator that helps us get out before market crashes, but also charts to help us get back in near the bottom, such as the Expected Market Volatility Spikes.

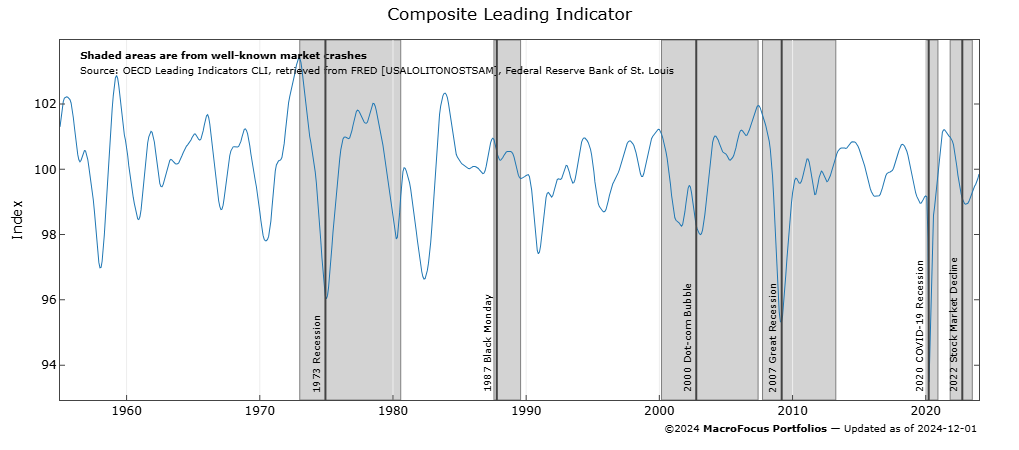

- And lastly, our Economy Related Charts, such as the Composite Leading Indicators.

Anaheim, CA, USA

ed@mf-portfolios.net